us japan tax treaty interest withholding

Withholding tax specifically applies to interest or dividends paid out to investors and usually applies to foreign investors. Hence you get 100 of your dividend payouts from stocks or ETFs listed on the SGX.

Pillar 1 Tax Treaties And Congressional Approval

Thats why many Singapore dividend investors like to invest.

. WHT at a rate 15 therefore applies on gross dividend payments interest management fees and royalty payments in respect of non-treaty countries. Certain pension funds retirement funds sports bodies collective investment funds and employee share ownership trusts. There is no dividend withholding tax in the Singapore markets.

Individuals who are resident in a tax treaty country or in another EU member state. Waitmy dividends get taxed. According to Section 831 of the ITA a tax is imposed on every non-resident person who derives any dividend interest royalty rent natural resource payment or management charge from sources in Uganda.

Companies that make a dividend distribution are required within 14 days of the end of the month in which the distribution is made to make a return to the tax authorities.

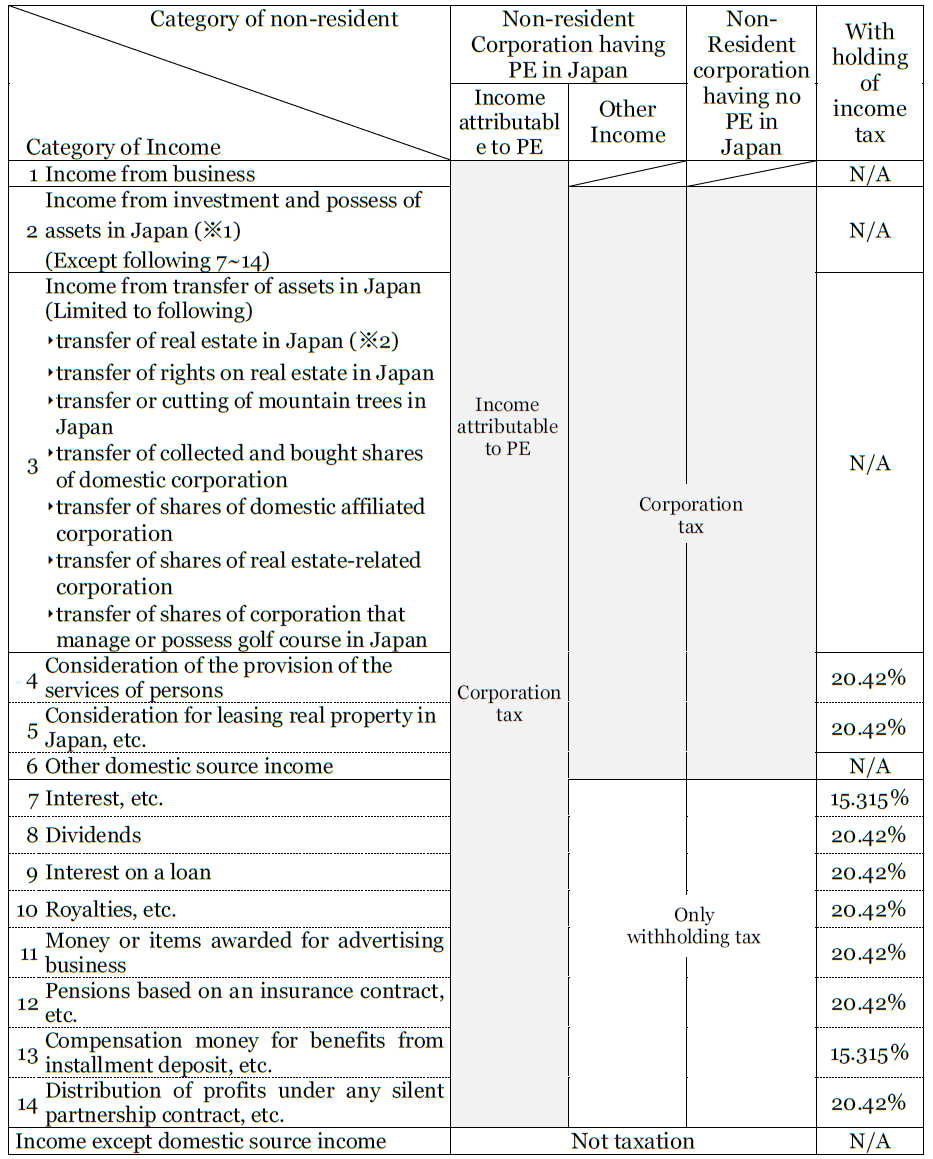

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Withholding Of Taxes On Payments To Foreign Persons Lorman Education Services

The Netherlands Proposes Changes To Dividend Withholding Tax Insights Dla Piper Global Law Firm

South Korea Tax Treaty International Tax Treaties Compliance Freeman Law

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Tax Form W8ben Step By Step Guide Envato Author Help Center Tax Forms Step Guide Form